How PizzaBox Subscriptions Supercharge Pizzeria Growth

Wednesday , 25 Sept 2024

3 min read

From Dough to Dollars: How PizzaBox Subscriptions Supercharge Pizzeria Growth

Owning a pizzeria is no small task—especially when it comes to raising the funds necessary for growth and success. They face tight margins and increasing competition, to address this problem many Point-of-Sale (POS) systems, like Toast, have introduced merchant financing options. On the surface, these seem like a fast and convenient way to access capital for your pizzeria. But when you dig deeper, you’ll see that this type of financing can leave your business in a tight spot. In contrast, the subscription model offers a more sustainable and profitable approach for pizzerias, particularly those looking to strengthen their community and drive long-term success.

Let’s break down both financing models and see why subscriptions might be a better choiceto keep your pizzeria thriving.

POS Merchant Financing: Quick Cash, Long-Term Struggles?

Let’s deep dive into Toast’s merchant financing. They allow pizzeria owners to borrow $20,000 by simple steps, just a click away. Toast’s AI reviews your sales data and cash flow, and just like that, the funds are in your account. For a busy pizzeria owner, this speed and simplicity might seem like a dream come true.

But here’s where things can get challenging:

- Fees & Deductions: Need to pay an upfront fee of 10-15%, and then 6-10% of your daily sales are automatically deducted to pay off the loan. There’s also a minimum amount to pay every month, no matter how your sales perform.

- High APR: Many pizzeria owners don’t realize that the annual interest rate (APR) can go as high as 40%, making it difficult to keep up with payments while running a profitable operation.

- Strain on Cash Flow: When daily sales are being automatically siphoned off, your ability to reinvest in business gets restricted. Even during a great sales day (or a Friday pizza rush), you may find your profits quickly disappear to cover loan repayments.

Most pizzerias use these loans to cover existing debts but rarely do they have enough capital left to invest in business and revenue-boosting initiatives like digital marketing, new pizza recipes, or customer loyalty programs. The result? A pizzeria that struggles to grow, all while their POS provider eats up a large slice of their profits.

The Subscriptions: The Recipe for Sustainable Success

Now, let’s look at the subscription model, a more community-driven and financially sustainable way for pizzerias to raise capital. Imagine you want to raise $20,000 for a new pizza oven or to expand your seating area. Instead of taking out a high-interest loan, you could sell 100 subscriptions to your customers at $197 each.

Why is this Subscriptions better for pizzerias?

- No Interest, No Fees: With subscriptions, there’s no interest to pay, and no hidden fees eating into your profits. All the money raised goes directly into your business.

- Build a Community of Pizza Lovers: Subscriptions don’t just raise money—they create loyalty. When you sell subscriptions, you’re turning your customers into repeat visitors. For example, with 100 subscribers visiting every week, you’ll have 5,200 visits in a year. That’s a loyal customer base that will keep coming back for your delicious pies.

- Boosting Sales: Subscribed customers often spend more during their visits, whether it’s upgrading their order to a family-sized pizza, adding extra toppings, or purchasing a dessert. Let’s say they spend an extra $5-$18 per visit—over time, that additional revenue can add up to $52,000 from those same 100 customers!

- Sustainable Growth: Instead of paying interest and fees, the subscription model allows you to reinvest your profits into growth. Whether that’s offering new menu items, improving your online ordering system, or running fun pizza nights, this model provides the financial flexibility to grow without the stress of loan repayments.

Why the Subscription Model is a Perfect Fit for Pizzerias

Pizzerias thrive on repeat customers, whether they’re families who love pizza night or college students grabbing a quick slice. The subscription model capitalizes on this natural customer loyalty by giving them a reason to come back week after week.

For example, by offering a Pizza Subscriptions, Pizzerias can raise capital without interest and fees. But the real value is in the long-term engagement with customers.. Subscribers will come back regularly, and each visit means more revenue for your pizzeria.

Here’s a quick breakdown of how the math works out:

- Sell 100 subscriptions at $197 each = $19,700 upfront.

- Those 100 customers visit weekly over a year, adding up to 5,200 visits.

- If each subscriber spends an additional $10 per visit, that’s an extra $52,000 in revenue.

It’s clear: by raising capital through subscriptions, you’re not only funding your next big project, but you’re also locking in a customer base that will keep your Pizzeria busy for months to come.

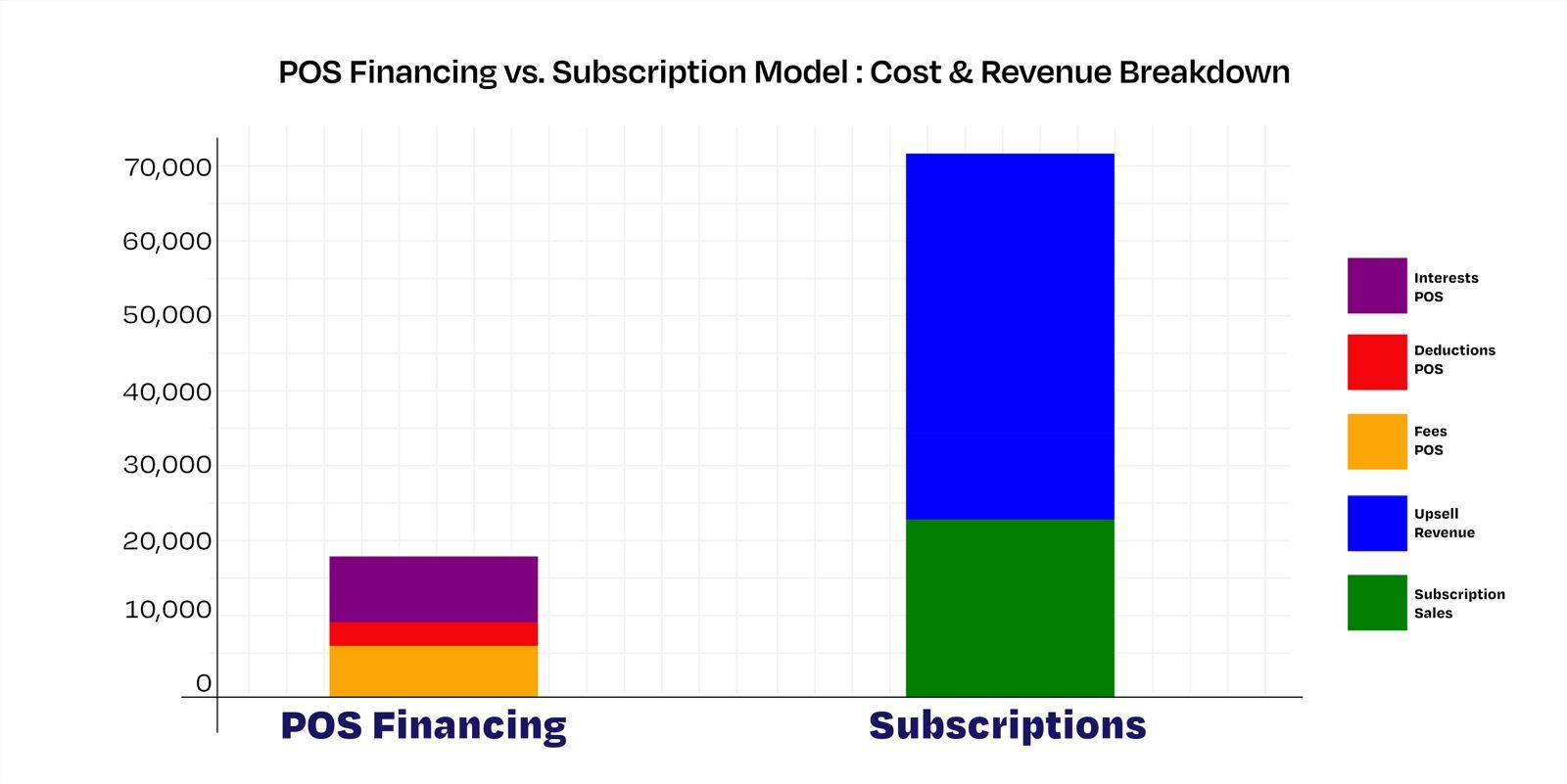

POS Financing vs. Subscriptions: The Numbers Don’t Lie

| POS Merchant Financing | Subscription Model |

|---|---|

| Borrow: $20,000 | Raise: $19,700 |

| APR: Up to 40% | Fees: $0 |

| Fees: 10-15% upfront + daily deductions | Interest: $0 |

| Potential hit to cash flow: Significant | Extra revenue from subscriber upsell: $52,000 |

Graphical Representation - Bar Chart Comparison:

-

Bar 1: POS Financing Costs

- Show upfront fees (10-15%), daily sales deductions (6-10%), and interest (up to 40%).

- Bar 2: Subscription Revenue

- Show subscription sales ($19,700) and potential extra revenue from upselling ($52,000)

A Smarter Financing Choice for Pizzerias

When you weigh the two, the choice is clear: why give away a chunk of your profits to a POS system when your customers are ready to support you directly? With the subscription model, you’re building a pizza-loving community that guarantees regular business AND upfront capital.

Ready to turn your loyal pizza fans into your greatest asset? Learn more at PizzaBox Subscriptions and start building a loyal community with no extra costs.